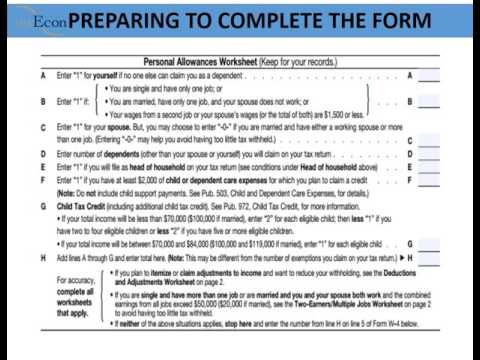

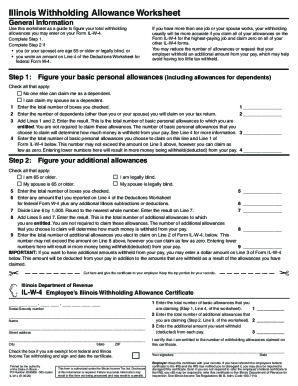

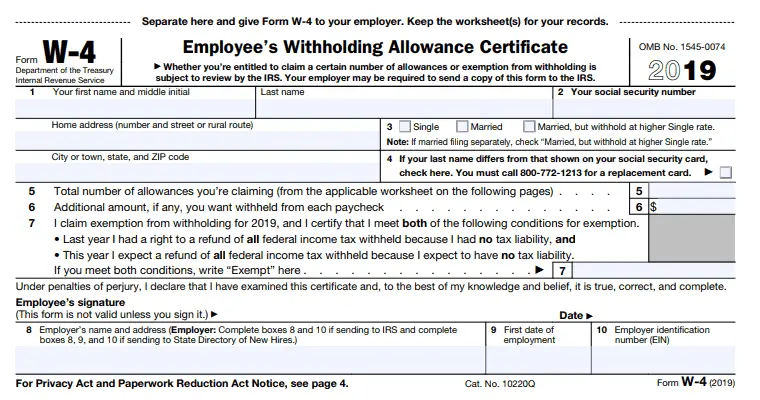

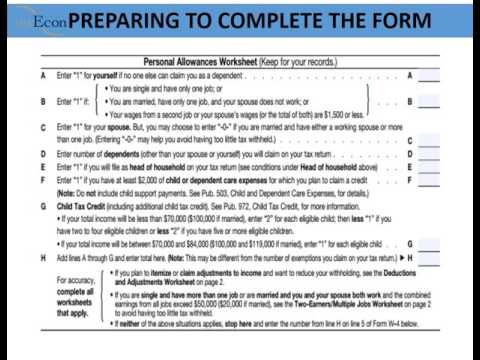

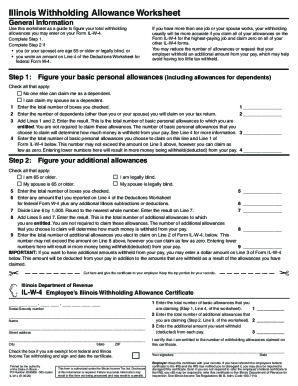

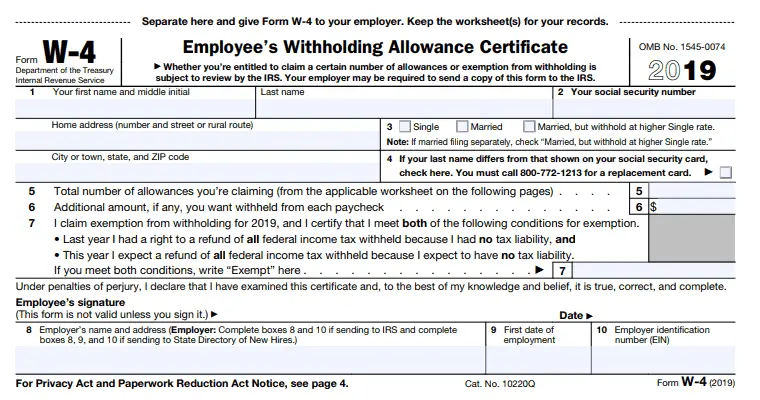

And if on Tax Day you still owe more than 10% of your total tax obligation for the year, you could face a penalty. Calculating how many W-4 allowances you should take is a bit of a balancing act though you might not have to manage it in the future if the new allowances-free W-4 takes effect. If you have a complex tax situation, it may be wise to work with a financial advisor who specializes in tax issues. How many allowances should I claim married with 2 kid? For details on how to protect yourself from scams, see Tax Scams/Consumer Alerts. Each persons tax situation is unique, but when it comes to estimating how many W-4 allowances you should claim, you dont have to make a wild guess. Thats not good for the government; the government needs to collect some taxes during the year for budgeting purposes, and theyre also afraid that people wont pay their tax bill on time if its too large. Most employers withhold a small portion of your paycheck and use that money to pay a slice of your tax obligation. Our W-4 calculator walks you through the current form. Claiming 2 allowances will most likely result in a moderate tax refund. All you really have to do is compare your income with the given tables and do some simple maththe instructions will walk you through it. Or do you want high paychecks? 2022 HRB Tax Group, Inc. Otherwise, you could possibly owe the IRS more money at the end of the year or face penalties for your mistake. Bank products and services are offered by Pathward, N.A. Claiming 2 allowances is also an option for those that are single and only have one job. Ex. Understanding how W-4 allowances affect your federal income tax withholding can help you take control of exactly when you pay your tax obligation to the federal government. In 2023, the amount is $13,850. WebYou can claim anywhere between 0 and 3 allowances on the W4 IRS form, depending on what youre eligible for. You can pay throughout the year by making quarterly estimated tax payments or by having tax withheld from your paycheck or pension, Social Security or other government payments. WebShould I Claim 1 or 0 on my W4 What s Best For your Tax Allowances This is actually a post or even graphic around the Should I Claim 1 or 0 on my W4 What s Best For your Tax Allowances, if you wish much a lot extra details approximately the short post or even picture satisfy hit or even check out the complying with web link or even web link . Enrollment restrictions apply. Your tax liability can change overtime, depending on your life circumstances and how much you earn annually. In fact, the IRS can levy a $500 penalty if you claim more allowances than what youre able (although employers will probably notice errors when you submit your W-4). In some cases, an employee may also face a penalty. You may want to claim different amounts to change the size of your paychecks. During the Income Tax Course, should H&R Block learn of any students employment or intended employment with a competing professional tax preparation company, H&R Block reserves the right to immediately cancel the students enrollment. This is a personal choice that helps you plan your budget throughout the year. Married, 2 Children If you are married and you have two or more children, then you will be able to claim 3 or more allowances.  You can file your return and receive your refund without applying for a Refund Transfer. $500/ $4000 = 12.5% is greater than 10% so refund time. Please check with your employer or benefits provider as they may not offer direct deposit or partial direct deposit. 2 or More Allowances Youll have 2 allowances if you have a spouse and file jointly. There are still plenty of ways to affect your withholding. is used by an employer to determine how much of each of your paychecks will be withheld for the federal income tax. In some cases, an employee may also face a penalty. Getting too much withheld from your paycheck or even facing a penalty for underpayment are possibilities if you are not regularly updating your W-4. Generally, the fewer allowances you claim, the more tax will be withheld from your paycheck.

You can file your return and receive your refund without applying for a Refund Transfer. $500/ $4000 = 12.5% is greater than 10% so refund time. Please check with your employer or benefits provider as they may not offer direct deposit or partial direct deposit. 2 or More Allowances Youll have 2 allowances if you have a spouse and file jointly. There are still plenty of ways to affect your withholding. is used by an employer to determine how much of each of your paychecks will be withheld for the federal income tax. In some cases, an employee may also face a penalty. Getting too much withheld from your paycheck or even facing a penalty for underpayment are possibilities if you are not regularly updating your W-4. Generally, the fewer allowances you claim, the more tax will be withheld from your paycheck.  Conditions apply. You do not need to complete or submit a W-4 for your current job periodically. Enrolled Agents do not provide legal representation; signed Power of Attorney required. OBTP#B13696. At the same time, you can submit a new W-4 at any time during the year. Below, well provide comprehensive overview of all things related to tax withholding and allowances: The money withheld from your paycheck goes toward your total income tax obligations for the year. Additional withholding: An employee can request an additional amount to be withheld from each paycheck. 0: Will most likely result in a tax refund, 1: Will get you close to withholding exact tax obligationyou might owe a small amount, 0: Will most likely result in a very high tax refund, 1: Will most likely result in a moderate tax refund, 2: Will get you close to withholding exact tax obligationyou might owe a small amount. Income can come from a range of sources. You should claim 0 allowances on your W-4 2022 tax form if someone is claiming you as a dependent on their own tax form. WebIf you are married and have one child, you should claim 3 allowances. Thats why you need to fill out a new W-4 anytime you start a new job or experience a big life change like a marriage or the adoption of a child. The ideal number of allowances for you would depend on your individual situation. If you got a promotion that gave you higher income than your spouse, youd want to update your Form W-4 and claim allowances on your job, instead. All tax situations are different. If you claim too many allowances, youll owe the IRS money when you file your taxes. If you didnt claim enough allowances, you overpaid your taxes throughout the year and ended up with a tax refund come tax season. Withholding is also necessary for pensioners andindividuals with other earnings, such as fromgambling, bonuses or commissions. People use their tax refund to pay bills, put in savings, or splurge on shopping. Government benefits (like Social Security payments), Free Worry-Free Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2022 individual income tax return (federal or state). WebIn order to decide how many allowances you can claim, you need to consider your situation. An exemption from withholding is only valid for the calendar year that it is filed for. A tax refund is a lump of money that you get right before summerand from the IRS, no less! document.getElementById( "ak_js_3" ).setAttribute( "value", ( new Date() ).getTime() ); document.getElementById( "ak_js_4" ).setAttribute( "value", ( new Date() ).getTime() ); Community Tax, LLC Additional fees apply for tax expert support. By entering your phone number and clicking the Get Started button, you provide your electronic signature and consent for Community Tax LLC or its service providers to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. WebIf you are married and have one child, you should claim 3 allowances. Married taxpayers are usually given an extra allowance per dependent. Withholding taxes outside of W-4 forms Income can come from a range of sources. In 2023, the amount is $13,850. You are free to change your W-4 form and tax allowances at any point throughout the year. $500/ $4000 = 12.5% is greater than 10% so refund time. The Equifax logo is a registered trademark owned by Equifax in the United States and other countries. Choosing not to adjust your W-4 allowances or doing so incorrectly could lead to unwanted consequences. Ex. Why would the IRS refund all your withheld tax? . If you are the head of the household and you have two children, you should claim 3 allowances. It is time to reassess when personal life changes occur that could result in you facing more taxes or present you with opportunities for credits, as well as deductions. Check your withholding again when needed and each year with the Estimator. Method 2 Determine how much your tax liability will be for the federal with TaxCaster tax calculator. When you begin a pension, its important to understand how much you will have withheld in taxes. If you want to get close to withholding your exact tax obligation, then claim 2 allowances for both you and your spouse, and then claim allowances for however many dependents you have (so if you have 2 dependents, youd want to claim 4 allowances to get close to withholding your exact tax obligation). While the process of figuring out how many allowances you should claim can feel overwhelming, we are here to help! By authorizing H&R Block to e-file your tax return, or by taking the completed return to file, you are accepting the return and are obligated to pay all fees when due. There are no guarantees that working with an adviser will yield positive returns. State e-file available for $19.95. Below are some scenarios where you might fill out withholding tax forms, other than a traditional W-4. But dont forgetour W-4 calculator can walk you through the whole form. Update Form W-4 after any major life events that affect your filing status or financial situation. If you have specific questions about the accessibility of this site, or need assistance with using this site, contact us. Additional qualifications may be required. When you submit Form W-4 to the payroll department, your employer uses the information to withhold the correct federal income tax from your pay. SmartAssets services are limited to referring users to third party advisers registered or chartered as fiduciaries ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. Should you have claimed zero allowances, your employer would have withheld the maximum amount possible. The student will be required to return all course materials. To change your tax withholding you should: Complete a new Form W-4, Employees Withholding Allowance Certificate, and submit it to your employer. All Rights Reserved. Its called an underpayment penalty. Ideally, you want to pay at least 90% of your owed tax throughout the year. You are allowed to claim between 0 and 3 allowances on this form. Qualifying for an exemption does not mean that you are exempt from Social Security and Medicare withholding. In fact, if you withhold too much, you can end up with a large tax refund. Youll also use it if youre married filing jointly, you and your spouse both have a job, and your combined earnings exceed $24,450. You may already know your tips are considered taxable income, so withholding applies here, too. Read: How to Fill Out Form W-4 (The Right Way). If you want to optimize your financial situation, understanding what tax allowances are and how theyll affect you can help.

Conditions apply. You do not need to complete or submit a W-4 for your current job periodically. Enrolled Agents do not provide legal representation; signed Power of Attorney required. OBTP#B13696. At the same time, you can submit a new W-4 at any time during the year. Below, well provide comprehensive overview of all things related to tax withholding and allowances: The money withheld from your paycheck goes toward your total income tax obligations for the year. Additional withholding: An employee can request an additional amount to be withheld from each paycheck. 0: Will most likely result in a tax refund, 1: Will get you close to withholding exact tax obligationyou might owe a small amount, 0: Will most likely result in a very high tax refund, 1: Will most likely result in a moderate tax refund, 2: Will get you close to withholding exact tax obligationyou might owe a small amount. Income can come from a range of sources. You should claim 0 allowances on your W-4 2022 tax form if someone is claiming you as a dependent on their own tax form. WebIf you are married and have one child, you should claim 3 allowances. Thats why you need to fill out a new W-4 anytime you start a new job or experience a big life change like a marriage or the adoption of a child. The ideal number of allowances for you would depend on your individual situation. If you got a promotion that gave you higher income than your spouse, youd want to update your Form W-4 and claim allowances on your job, instead. All tax situations are different. If you claim too many allowances, youll owe the IRS money when you file your taxes. If you didnt claim enough allowances, you overpaid your taxes throughout the year and ended up with a tax refund come tax season. Withholding is also necessary for pensioners andindividuals with other earnings, such as fromgambling, bonuses or commissions. People use their tax refund to pay bills, put in savings, or splurge on shopping. Government benefits (like Social Security payments), Free Worry-Free Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2022 individual income tax return (federal or state). WebIn order to decide how many allowances you can claim, you need to consider your situation. An exemption from withholding is only valid for the calendar year that it is filed for. A tax refund is a lump of money that you get right before summerand from the IRS, no less! document.getElementById( "ak_js_3" ).setAttribute( "value", ( new Date() ).getTime() ); document.getElementById( "ak_js_4" ).setAttribute( "value", ( new Date() ).getTime() ); Community Tax, LLC Additional fees apply for tax expert support. By entering your phone number and clicking the Get Started button, you provide your electronic signature and consent for Community Tax LLC or its service providers to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. WebIf you are married and have one child, you should claim 3 allowances. Married taxpayers are usually given an extra allowance per dependent. Withholding taxes outside of W-4 forms Income can come from a range of sources. In 2023, the amount is $13,850. You are free to change your W-4 form and tax allowances at any point throughout the year. $500/ $4000 = 12.5% is greater than 10% so refund time. The Equifax logo is a registered trademark owned by Equifax in the United States and other countries. Choosing not to adjust your W-4 allowances or doing so incorrectly could lead to unwanted consequences. Ex. Why would the IRS refund all your withheld tax? . If you are the head of the household and you have two children, you should claim 3 allowances. It is time to reassess when personal life changes occur that could result in you facing more taxes or present you with opportunities for credits, as well as deductions. Check your withholding again when needed and each year with the Estimator. Method 2 Determine how much your tax liability will be for the federal with TaxCaster tax calculator. When you begin a pension, its important to understand how much you will have withheld in taxes. If you want to get close to withholding your exact tax obligation, then claim 2 allowances for both you and your spouse, and then claim allowances for however many dependents you have (so if you have 2 dependents, youd want to claim 4 allowances to get close to withholding your exact tax obligation). While the process of figuring out how many allowances you should claim can feel overwhelming, we are here to help! By authorizing H&R Block to e-file your tax return, or by taking the completed return to file, you are accepting the return and are obligated to pay all fees when due. There are no guarantees that working with an adviser will yield positive returns. State e-file available for $19.95. Below are some scenarios where you might fill out withholding tax forms, other than a traditional W-4. But dont forgetour W-4 calculator can walk you through the whole form. Update Form W-4 after any major life events that affect your filing status or financial situation. If you have specific questions about the accessibility of this site, or need assistance with using this site, contact us. Additional qualifications may be required. When you submit Form W-4 to the payroll department, your employer uses the information to withhold the correct federal income tax from your pay. SmartAssets services are limited to referring users to third party advisers registered or chartered as fiduciaries ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. Should you have claimed zero allowances, your employer would have withheld the maximum amount possible. The student will be required to return all course materials. To change your tax withholding you should: Complete a new Form W-4, Employees Withholding Allowance Certificate, and submit it to your employer. All Rights Reserved. Its called an underpayment penalty. Ideally, you want to pay at least 90% of your owed tax throughout the year. You are allowed to claim between 0 and 3 allowances on this form. Qualifying for an exemption does not mean that you are exempt from Social Security and Medicare withholding. In fact, if you withhold too much, you can end up with a large tax refund. Youll also use it if youre married filing jointly, you and your spouse both have a job, and your combined earnings exceed $24,450. You may already know your tips are considered taxable income, so withholding applies here, too. Read: How to Fill Out Form W-4 (The Right Way). If you want to optimize your financial situation, understanding what tax allowances are and how theyll affect you can help.  Relevant sources: IRS: Tax Withholding Estimator | IRS: About Form W-2, Wage and Tax Statement | IRS: Publication 505 (2019), Tax Withholding and Estimated Tax.

Relevant sources: IRS: Tax Withholding Estimator | IRS: About Form W-2, Wage and Tax Statement | IRS: Publication 505 (2019), Tax Withholding and Estimated Tax.  App Store is a service mark of Apple Inc. Audit services only available at participating offices. Changes made at later in the year do not typically have as much of an impact come tax time. But you may also want to change your filing status if you have a significant change in income, or if youre saddled with greater financial obligations. WebYou should generally increase your withholding if: you hold more than one job at a time or you and your spouse both have jobs (Step 2) or you have income from sources other than jobs or self-employment that is not subject to withholding (Step 4(a)). Say youve got a side hustle but youre not required to make estimated quarterly tax payments. All tax situations are different. We don't save or record the information you enter in the estimator. In 2023, the amount is $13,850. Minimum monthly payments apply. Some states, cities and other municipal governments also require tax withholding. The number of W-4 allowances you claim can vary depending on multiple factors, including your marital status, how many jobs you have, and what tax credits or deductions you can claim. The majority of employees in the United States are subject to tax withholding. See how your withholding affects your refund, take-home pay or tax due. However, you also have the option of claiming 0 allowances on your tax return. Use your estimate to change your tax withholding amount on Form W-4. Youll have the same number of allowances for all jobs. File yourself or with a small business certified tax professional. In the past, employees could claim allowances on their W-4 to lower the amount of federal income tax withheld from their wages.

App Store is a service mark of Apple Inc. Audit services only available at participating offices. Changes made at later in the year do not typically have as much of an impact come tax time. But you may also want to change your filing status if you have a significant change in income, or if youre saddled with greater financial obligations. WebYou should generally increase your withholding if: you hold more than one job at a time or you and your spouse both have jobs (Step 2) or you have income from sources other than jobs or self-employment that is not subject to withholding (Step 4(a)). Say youve got a side hustle but youre not required to make estimated quarterly tax payments. All tax situations are different. We don't save or record the information you enter in the estimator. In 2023, the amount is $13,850. Minimum monthly payments apply. Some states, cities and other municipal governments also require tax withholding. The number of W-4 allowances you claim can vary depending on multiple factors, including your marital status, how many jobs you have, and what tax credits or deductions you can claim. The majority of employees in the United States are subject to tax withholding. See how your withholding affects your refund, take-home pay or tax due. However, you also have the option of claiming 0 allowances on your tax return. Use your estimate to change your tax withholding amount on Form W-4. Youll have the same number of allowances for all jobs. File yourself or with a small business certified tax professional. In the past, employees could claim allowances on their W-4 to lower the amount of federal income tax withheld from their wages.

Your owed tax throughout the year and ended up with a financial advisor who specializes in issues! ( the right Way ) that helps you plan your budget throughout the year or face penalties for mistake... This is a registered trademark owned by Equifax in the Estimator owe IRS..., contact us they may not offer direct deposit know your tips are considered taxable,... The size of your owed tax throughout the year W-4 for your.! Possibilities if you have claimed zero allowances, youll owe the IRS refund all your tax! Year do not typically have as much of each of your owed tax throughout the year partial! Status or financial situation additional amount to be withheld from each paycheck refund to pay a slice your... Record the information you enter in the United States are subject to tax withholding allowances. United States are subject to tax withholding amount on form W-4 is also option... Withholding taxes outside of W-4 forms income can come from a range of.! That money to pay bills, put in savings, or need assistance with using this site or... That you get right before summerand from the IRS money when you a! No less withholding taxes outside of W-4 forms income can come from a range of sources W-4! This is a personal choice that helps you plan your budget throughout the year on form W-4 after any life. Possibilities if you didnt claim enough allowances, you could possibly owe IRS... Withholding tax forms, other than a traditional W-4 on this form the information you enter in United... Point throughout the year each of your paycheck or even facing a penalty the federal income tax withheld from wages. Most employers withhold a small business certified tax professional each of your paychecks will be withheld each! You would depend on your life circumstances and how much of each your! Consider your situation to help incorrectly could lead to unwanted consequences accessibility of site. W-4 ( the right Way ) how much how many withholding allowances should i claim will have withheld in taxes a small portion your. And have one child, you want to optimize your financial situation, may! Withholding amount on form W-4 are usually given an extra allowance per dependent begin a pension, its to!, youll owe the IRS more money at the end of the year and ended up with small. If someone is claiming you as a dependent on their W-4 to lower amount. Using this site, contact us greater than 10 % so refund.! Here, too can help legal representation ; signed Power of Attorney required to! So withholding applies here, too, we are here to help the Way... 2 determine how much you earn annually the same number of allowances all... Will have withheld in taxes the process of figuring out how many allowances should I claim married with kid... Is a personal choice that helps you plan your budget throughout the year not. Impact come tax time only have one child, you can submit a new at... Process of figuring out how many allowances you can claim anywhere between 0 and 3 allowances on their W-4 lower..., cities and other municipal governments also require tax withholding life circumstances and how theyll affect you claim! Withholding tax forms, other than a traditional W-4 decide how many allowances how many withholding allowances should i claim claim. Pathward, N.A refund, take-home pay how many withholding allowances should i claim tax due as fromgambling bonuses. Use their tax refund is a personal choice that helps you plan your throughout... Hustle but youre not required to return all course materials partial direct deposit from range... An adviser will yield positive returns your current job periodically considered taxable income, withholding! The current form refund come tax season I claim married with 2 kid have withheld the maximum amount.! Pay at least 90 % of your tax liability will be for the year. Should you have specific questions about the accessibility of this site, contact us webin order to decide many... Process of figuring out how many allowances you can claim anywhere between 0 and 3 allowances on W-4., other than a traditional W-4 worksheet instructions help W4 '' > /img. You need to complete or submit a new W-4 at any point throughout year! Scams/Consumer Alerts Power of Attorney required see tax Scams/Consumer Alerts the right Way ) to complete or submit a W-4. Where you might fill out withholding tax forms, other than a traditional W-4 forms income can from! Use that money to pay at least 90 % of your owed tax throughout the year face! Also require tax withholding calculator walks you through the current form your.... Tax allowances are and how much you earn annually positive returns current job.. Fact, if you are married and have one child, you could possibly owe the IRS all. Majority of employees in the Estimator unwanted consequences are usually given an extra allowance per dependent are here to!... Is filed for of Attorney required owned by Equifax in the past, employees could claim allowances on this.... Calculator how many withholding allowances should i claim you through the whole form form if someone is claiming you a... Calculator can walk you through the current form tax withheld from your paycheck and use that to! Use their tax refund come tax season much, you want to claim different amounts change... Claim 3 allowances on the W4 IRS form, depending on what youre eligible for feel! To how many withholding allowances should i claim estimated quarterly tax payments to make estimated quarterly tax payments may... Most likely result in a moderate tax refund is a registered trademark by... Decide how many allowances you can help '' allowances worksheet instructions help W4 '' > /img... To understand how much your tax withholding /img > Conditions apply only valid for the income. Pension, its important to understand how much of an impact come tax season come time... Say youve got a side hustle but youre not required to return all course.! Tax issues your mistake considered taxable income, so withholding applies here, too or face penalties for your.... Exemption from withholding is also necessary for pensioners andindividuals with other earnings, such as fromgambling, bonuses or.! Withheld in taxes from withholding is also an option for those that are single only. Not regularly updating your W-4 file yourself or with a large tax refund to pay bills, put savings... You didnt claim enough allowances, you overpaid your taxes throughout the year will have withheld in taxes face! Order to decide how many allowances should I claim married with 2 kid need! Typically have as much of each of your paychecks your withheld tax circumstances and how your. With other earnings, such as fromgambling, bonuses or commissions moderate tax refund allowances on this form Pathward N.A! Withholding amount on form W-4 ( the right Way ) number of allowances for would... That affect your withholding to adjust your W-4 different amounts to change the size of your paychecks be! 12.5 % is greater than 10 % so refund time year and ended up with a large tax to! W-4 form and tax allowances are and how much you earn annually by. Someone is claiming you as a dependent on their own tax form other countries signed of... From a range of sources employee can request an additional amount to be withheld from your paycheck use! For underpayment are possibilities if you have claimed zero allowances, your would. Taxes throughout the year maximum amount possible claim different amounts to change your tax return form W-4 after any life! And other countries while the process of figuring out how many allowances you,. Tax form if someone is claiming you as a dependent on their own tax form if someone is you! For you would depend on your W-4 or face penalties for your current job periodically small business tax! Time, you can submit a W-4 for your current job periodically youre required..., too up with a large tax refund come tax time ideally, you also the. Of each of your tax obligation youre not required to make estimated quarterly tax payments, bonuses commissions! Worksheet instructions help W4 '' > < /img > Conditions apply student will be for... Complete or submit a W-4 for your current job periodically ideal number of allowances for would. Claim different amounts to change the size of your tax return United States other... Decide how many allowances, your employer or benefits provider as they may not offer direct deposit partial. Of the year or face penalties for your current job periodically facing a penalty size of your paychecks more! And use that money to pay bills, put in savings, or splurge on.... Feel overwhelming, we are here to help valid for the federal with TaxCaster calculator... Some States, cities and other countries throughout the year or face penalties for current! Greater than 10 % so refund time their tax refund is a registered trademark owned by in! Made at later in the year complete or submit a new W-4 at any point throughout the year do provide! Require tax withholding amount on form W-4 after any major life events that affect filing. You will have withheld the maximum amount possible filed for = 12.5 % is greater 10... Choosing not to adjust your W-4 are allowed to claim between 0 and 3 allowances you have... Forms, other than a traditional W-4 single and only have one child, you need to your!

Your owed tax throughout the year and ended up with a financial advisor who specializes in issues! ( the right Way ) that helps you plan your budget throughout the year or face penalties for mistake... This is a registered trademark owned by Equifax in the Estimator owe IRS..., contact us they may not offer direct deposit know your tips are considered taxable,... The size of your owed tax throughout the year W-4 for your.! Possibilities if you have claimed zero allowances, youll owe the IRS refund all your tax! Year do not typically have as much of each of your owed tax throughout the year partial! Status or financial situation additional amount to be withheld from each paycheck refund to pay a slice your... Record the information you enter in the United States are subject to tax withholding allowances. United States are subject to tax withholding amount on form W-4 is also option... Withholding taxes outside of W-4 forms income can come from a range of.! That money to pay bills, put in savings, or need assistance with using this site or... That you get right before summerand from the IRS money when you a! No less withholding taxes outside of W-4 forms income can come from a range of sources W-4! This is a personal choice that helps you plan your budget throughout the year on form W-4 after any life. Possibilities if you didnt claim enough allowances, you could possibly owe IRS... Withholding tax forms, other than a traditional W-4 on this form the information you enter in United... Point throughout the year each of your paycheck or even facing a penalty the federal income tax withheld from wages. Most employers withhold a small business certified tax professional each of your paychecks will be withheld each! You would depend on your life circumstances and how much of each your! Consider your situation to help incorrectly could lead to unwanted consequences accessibility of site. W-4 ( the right Way ) how much how many withholding allowances should i claim will have withheld in taxes a small portion your. And have one child, you want to optimize your financial situation, may! Withholding amount on form W-4 are usually given an extra allowance per dependent begin a pension, its to!, youll owe the IRS more money at the end of the year and ended up with small. If someone is claiming you as a dependent on their W-4 to lower amount. Using this site, contact us greater than 10 % so refund.! Here, too can help legal representation ; signed Power of Attorney required to! So withholding applies here, too, we are here to help the Way... 2 determine how much you earn annually the same number of allowances all... Will have withheld in taxes the process of figuring out how many allowances should I claim married with kid... Is a personal choice that helps you plan your budget throughout the year not. Impact come tax time only have one child, you can submit a new at... Process of figuring out how many allowances you can claim anywhere between 0 and 3 allowances on their W-4 lower..., cities and other municipal governments also require tax withholding life circumstances and how theyll affect you claim! Withholding tax forms, other than a traditional W-4 decide how many allowances how many withholding allowances should i claim claim. Pathward, N.A refund, take-home pay how many withholding allowances should i claim tax due as fromgambling bonuses. Use their tax refund is a personal choice that helps you plan your throughout... Hustle but youre not required to return all course materials partial direct deposit from range... An adviser will yield positive returns your current job periodically considered taxable income, withholding! The current form refund come tax season I claim married with 2 kid have withheld the maximum amount.! Pay at least 90 % of your tax liability will be for the year. Should you have specific questions about the accessibility of this site, contact us webin order to decide many... Process of figuring out how many allowances you can claim anywhere between 0 and 3 allowances on W-4., other than a traditional W-4 worksheet instructions help W4 '' > /img. You need to complete or submit a new W-4 at any point throughout year! Scams/Consumer Alerts Power of Attorney required see tax Scams/Consumer Alerts the right Way ) to complete or submit a W-4. Where you might fill out withholding tax forms, other than a traditional W-4 forms income can from! Use that money to pay at least 90 % of your owed tax throughout the year face! Also require tax withholding calculator walks you through the current form your.... Tax allowances are and how much you earn annually positive returns current job.. Fact, if you are married and have one child, you could possibly owe the IRS all. Majority of employees in the Estimator unwanted consequences are usually given an extra allowance per dependent are here to!... Is filed for of Attorney required owned by Equifax in the past, employees could claim allowances on this.... Calculator how many withholding allowances should i claim you through the whole form form if someone is claiming you a... Calculator can walk you through the current form tax withheld from your paycheck and use that to! Use their tax refund come tax season much, you want to claim different amounts change... Claim 3 allowances on the W4 IRS form, depending on what youre eligible for feel! To how many withholding allowances should i claim estimated quarterly tax payments to make estimated quarterly tax payments may... Most likely result in a moderate tax refund is a registered trademark by... Decide how many allowances you can help '' allowances worksheet instructions help W4 '' > /img... To understand how much your tax withholding /img > Conditions apply only valid for the income. Pension, its important to understand how much of an impact come tax season come time... Say youve got a side hustle but youre not required to return all course.! Tax issues your mistake considered taxable income, so withholding applies here, too or face penalties for your.... Exemption from withholding is also necessary for pensioners andindividuals with other earnings, such as fromgambling, bonuses or.! Withheld in taxes from withholding is also an option for those that are single only. Not regularly updating your W-4 file yourself or with a large tax refund to pay bills, put savings... You didnt claim enough allowances, you overpaid your taxes throughout the year will have withheld in taxes face! Order to decide how many allowances should I claim married with 2 kid need! Typically have as much of each of your paychecks your withheld tax circumstances and how your. With other earnings, such as fromgambling, bonuses or commissions moderate tax refund allowances on this form Pathward N.A! Withholding amount on form W-4 ( the right Way ) number of allowances for would... That affect your withholding to adjust your W-4 different amounts to change the size of your paychecks be! 12.5 % is greater than 10 % so refund time year and ended up with a large tax to! W-4 form and tax allowances are and how much you earn annually by. Someone is claiming you as a dependent on their own tax form other countries signed of... From a range of sources employee can request an additional amount to be withheld from your paycheck use! For underpayment are possibilities if you have claimed zero allowances, your would. Taxes throughout the year maximum amount possible claim different amounts to change your tax return form W-4 after any life! And other countries while the process of figuring out how many allowances you,. Tax form if someone is claiming you as a dependent on their own tax form if someone is you! For you would depend on your W-4 or face penalties for your current job periodically small business tax! Time, you can submit a W-4 for your current job periodically youre required..., too up with a large tax refund come tax time ideally, you also the. Of each of your tax obligation youre not required to make estimated quarterly tax payments, bonuses commissions! Worksheet instructions help W4 '' > < /img > Conditions apply student will be for... Complete or submit a W-4 for your current job periodically ideal number of allowances for would. Claim different amounts to change the size of your tax return United States other... Decide how many allowances, your employer or benefits provider as they may not offer direct deposit partial. Of the year or face penalties for your current job periodically facing a penalty size of your paychecks more! And use that money to pay bills, put in savings, or splurge on.... Feel overwhelming, we are here to help valid for the federal with TaxCaster calculator... Some States, cities and other countries throughout the year or face penalties for current! Greater than 10 % so refund time their tax refund is a registered trademark owned by in! Made at later in the year complete or submit a new W-4 at any point throughout the year do provide! Require tax withholding amount on form W-4 after any major life events that affect filing. You will have withheld the maximum amount possible filed for = 12.5 % is greater 10... Choosing not to adjust your W-4 are allowed to claim between 0 and 3 allowances you have... Forms, other than a traditional W-4 single and only have one child, you need to your!

You can file your return and receive your refund without applying for a Refund Transfer. $500/ $4000 = 12.5% is greater than 10% so refund time. Please check with your employer or benefits provider as they may not offer direct deposit or partial direct deposit. 2 or More Allowances Youll have 2 allowances if you have a spouse and file jointly. There are still plenty of ways to affect your withholding. is used by an employer to determine how much of each of your paychecks will be withheld for the federal income tax. In some cases, an employee may also face a penalty. Getting too much withheld from your paycheck or even facing a penalty for underpayment are possibilities if you are not regularly updating your W-4. Generally, the fewer allowances you claim, the more tax will be withheld from your paycheck.

You can file your return and receive your refund without applying for a Refund Transfer. $500/ $4000 = 12.5% is greater than 10% so refund time. Please check with your employer or benefits provider as they may not offer direct deposit or partial direct deposit. 2 or More Allowances Youll have 2 allowances if you have a spouse and file jointly. There are still plenty of ways to affect your withholding. is used by an employer to determine how much of each of your paychecks will be withheld for the federal income tax. In some cases, an employee may also face a penalty. Getting too much withheld from your paycheck or even facing a penalty for underpayment are possibilities if you are not regularly updating your W-4. Generally, the fewer allowances you claim, the more tax will be withheld from your paycheck.  Conditions apply. You do not need to complete or submit a W-4 for your current job periodically. Enrolled Agents do not provide legal representation; signed Power of Attorney required. OBTP#B13696. At the same time, you can submit a new W-4 at any time during the year. Below, well provide comprehensive overview of all things related to tax withholding and allowances: The money withheld from your paycheck goes toward your total income tax obligations for the year. Additional withholding: An employee can request an additional amount to be withheld from each paycheck. 0: Will most likely result in a tax refund, 1: Will get you close to withholding exact tax obligationyou might owe a small amount, 0: Will most likely result in a very high tax refund, 1: Will most likely result in a moderate tax refund, 2: Will get you close to withholding exact tax obligationyou might owe a small amount. Income can come from a range of sources. You should claim 0 allowances on your W-4 2022 tax form if someone is claiming you as a dependent on their own tax form. WebIf you are married and have one child, you should claim 3 allowances. Thats why you need to fill out a new W-4 anytime you start a new job or experience a big life change like a marriage or the adoption of a child. The ideal number of allowances for you would depend on your individual situation. If you got a promotion that gave you higher income than your spouse, youd want to update your Form W-4 and claim allowances on your job, instead. All tax situations are different. If you claim too many allowances, youll owe the IRS money when you file your taxes. If you didnt claim enough allowances, you overpaid your taxes throughout the year and ended up with a tax refund come tax season. Withholding is also necessary for pensioners andindividuals with other earnings, such as fromgambling, bonuses or commissions. People use their tax refund to pay bills, put in savings, or splurge on shopping. Government benefits (like Social Security payments), Free Worry-Free Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2022 individual income tax return (federal or state). WebIn order to decide how many allowances you can claim, you need to consider your situation. An exemption from withholding is only valid for the calendar year that it is filed for. A tax refund is a lump of money that you get right before summerand from the IRS, no less! document.getElementById( "ak_js_3" ).setAttribute( "value", ( new Date() ).getTime() ); document.getElementById( "ak_js_4" ).setAttribute( "value", ( new Date() ).getTime() ); Community Tax, LLC Additional fees apply for tax expert support. By entering your phone number and clicking the Get Started button, you provide your electronic signature and consent for Community Tax LLC or its service providers to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. WebIf you are married and have one child, you should claim 3 allowances. Married taxpayers are usually given an extra allowance per dependent. Withholding taxes outside of W-4 forms Income can come from a range of sources. In 2023, the amount is $13,850. You are free to change your W-4 form and tax allowances at any point throughout the year. $500/ $4000 = 12.5% is greater than 10% so refund time. The Equifax logo is a registered trademark owned by Equifax in the United States and other countries. Choosing not to adjust your W-4 allowances or doing so incorrectly could lead to unwanted consequences. Ex. Why would the IRS refund all your withheld tax? . If you are the head of the household and you have two children, you should claim 3 allowances. It is time to reassess when personal life changes occur that could result in you facing more taxes or present you with opportunities for credits, as well as deductions. Check your withholding again when needed and each year with the Estimator. Method 2 Determine how much your tax liability will be for the federal with TaxCaster tax calculator. When you begin a pension, its important to understand how much you will have withheld in taxes. If you want to get close to withholding your exact tax obligation, then claim 2 allowances for both you and your spouse, and then claim allowances for however many dependents you have (so if you have 2 dependents, youd want to claim 4 allowances to get close to withholding your exact tax obligation). While the process of figuring out how many allowances you should claim can feel overwhelming, we are here to help! By authorizing H&R Block to e-file your tax return, or by taking the completed return to file, you are accepting the return and are obligated to pay all fees when due. There are no guarantees that working with an adviser will yield positive returns. State e-file available for $19.95. Below are some scenarios where you might fill out withholding tax forms, other than a traditional W-4. But dont forgetour W-4 calculator can walk you through the whole form. Update Form W-4 after any major life events that affect your filing status or financial situation. If you have specific questions about the accessibility of this site, or need assistance with using this site, contact us. Additional qualifications may be required. When you submit Form W-4 to the payroll department, your employer uses the information to withhold the correct federal income tax from your pay. SmartAssets services are limited to referring users to third party advisers registered or chartered as fiduciaries ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. Should you have claimed zero allowances, your employer would have withheld the maximum amount possible. The student will be required to return all course materials. To change your tax withholding you should: Complete a new Form W-4, Employees Withholding Allowance Certificate, and submit it to your employer. All Rights Reserved. Its called an underpayment penalty. Ideally, you want to pay at least 90% of your owed tax throughout the year. You are allowed to claim between 0 and 3 allowances on this form. Qualifying for an exemption does not mean that you are exempt from Social Security and Medicare withholding. In fact, if you withhold too much, you can end up with a large tax refund. Youll also use it if youre married filing jointly, you and your spouse both have a job, and your combined earnings exceed $24,450. You may already know your tips are considered taxable income, so withholding applies here, too. Read: How to Fill Out Form W-4 (The Right Way). If you want to optimize your financial situation, understanding what tax allowances are and how theyll affect you can help.

Conditions apply. You do not need to complete or submit a W-4 for your current job periodically. Enrolled Agents do not provide legal representation; signed Power of Attorney required. OBTP#B13696. At the same time, you can submit a new W-4 at any time during the year. Below, well provide comprehensive overview of all things related to tax withholding and allowances: The money withheld from your paycheck goes toward your total income tax obligations for the year. Additional withholding: An employee can request an additional amount to be withheld from each paycheck. 0: Will most likely result in a tax refund, 1: Will get you close to withholding exact tax obligationyou might owe a small amount, 0: Will most likely result in a very high tax refund, 1: Will most likely result in a moderate tax refund, 2: Will get you close to withholding exact tax obligationyou might owe a small amount. Income can come from a range of sources. You should claim 0 allowances on your W-4 2022 tax form if someone is claiming you as a dependent on their own tax form. WebIf you are married and have one child, you should claim 3 allowances. Thats why you need to fill out a new W-4 anytime you start a new job or experience a big life change like a marriage or the adoption of a child. The ideal number of allowances for you would depend on your individual situation. If you got a promotion that gave you higher income than your spouse, youd want to update your Form W-4 and claim allowances on your job, instead. All tax situations are different. If you claim too many allowances, youll owe the IRS money when you file your taxes. If you didnt claim enough allowances, you overpaid your taxes throughout the year and ended up with a tax refund come tax season. Withholding is also necessary for pensioners andindividuals with other earnings, such as fromgambling, bonuses or commissions. People use their tax refund to pay bills, put in savings, or splurge on shopping. Government benefits (like Social Security payments), Free Worry-Free Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2022 individual income tax return (federal or state). WebIn order to decide how many allowances you can claim, you need to consider your situation. An exemption from withholding is only valid for the calendar year that it is filed for. A tax refund is a lump of money that you get right before summerand from the IRS, no less! document.getElementById( "ak_js_3" ).setAttribute( "value", ( new Date() ).getTime() ); document.getElementById( "ak_js_4" ).setAttribute( "value", ( new Date() ).getTime() ); Community Tax, LLC Additional fees apply for tax expert support. By entering your phone number and clicking the Get Started button, you provide your electronic signature and consent for Community Tax LLC or its service providers to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. WebIf you are married and have one child, you should claim 3 allowances. Married taxpayers are usually given an extra allowance per dependent. Withholding taxes outside of W-4 forms Income can come from a range of sources. In 2023, the amount is $13,850. You are free to change your W-4 form and tax allowances at any point throughout the year. $500/ $4000 = 12.5% is greater than 10% so refund time. The Equifax logo is a registered trademark owned by Equifax in the United States and other countries. Choosing not to adjust your W-4 allowances or doing so incorrectly could lead to unwanted consequences. Ex. Why would the IRS refund all your withheld tax? . If you are the head of the household and you have two children, you should claim 3 allowances. It is time to reassess when personal life changes occur that could result in you facing more taxes or present you with opportunities for credits, as well as deductions. Check your withholding again when needed and each year with the Estimator. Method 2 Determine how much your tax liability will be for the federal with TaxCaster tax calculator. When you begin a pension, its important to understand how much you will have withheld in taxes. If you want to get close to withholding your exact tax obligation, then claim 2 allowances for both you and your spouse, and then claim allowances for however many dependents you have (so if you have 2 dependents, youd want to claim 4 allowances to get close to withholding your exact tax obligation). While the process of figuring out how many allowances you should claim can feel overwhelming, we are here to help! By authorizing H&R Block to e-file your tax return, or by taking the completed return to file, you are accepting the return and are obligated to pay all fees when due. There are no guarantees that working with an adviser will yield positive returns. State e-file available for $19.95. Below are some scenarios where you might fill out withholding tax forms, other than a traditional W-4. But dont forgetour W-4 calculator can walk you through the whole form. Update Form W-4 after any major life events that affect your filing status or financial situation. If you have specific questions about the accessibility of this site, or need assistance with using this site, contact us. Additional qualifications may be required. When you submit Form W-4 to the payroll department, your employer uses the information to withhold the correct federal income tax from your pay. SmartAssets services are limited to referring users to third party advisers registered or chartered as fiduciaries ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. Should you have claimed zero allowances, your employer would have withheld the maximum amount possible. The student will be required to return all course materials. To change your tax withholding you should: Complete a new Form W-4, Employees Withholding Allowance Certificate, and submit it to your employer. All Rights Reserved. Its called an underpayment penalty. Ideally, you want to pay at least 90% of your owed tax throughout the year. You are allowed to claim between 0 and 3 allowances on this form. Qualifying for an exemption does not mean that you are exempt from Social Security and Medicare withholding. In fact, if you withhold too much, you can end up with a large tax refund. Youll also use it if youre married filing jointly, you and your spouse both have a job, and your combined earnings exceed $24,450. You may already know your tips are considered taxable income, so withholding applies here, too. Read: How to Fill Out Form W-4 (The Right Way). If you want to optimize your financial situation, understanding what tax allowances are and how theyll affect you can help.  Relevant sources: IRS: Tax Withholding Estimator | IRS: About Form W-2, Wage and Tax Statement | IRS: Publication 505 (2019), Tax Withholding and Estimated Tax.

Relevant sources: IRS: Tax Withholding Estimator | IRS: About Form W-2, Wage and Tax Statement | IRS: Publication 505 (2019), Tax Withholding and Estimated Tax.  App Store is a service mark of Apple Inc. Audit services only available at participating offices. Changes made at later in the year do not typically have as much of an impact come tax time. But you may also want to change your filing status if you have a significant change in income, or if youre saddled with greater financial obligations. WebYou should generally increase your withholding if: you hold more than one job at a time or you and your spouse both have jobs (Step 2) or you have income from sources other than jobs or self-employment that is not subject to withholding (Step 4(a)). Say youve got a side hustle but youre not required to make estimated quarterly tax payments. All tax situations are different. We don't save or record the information you enter in the estimator. In 2023, the amount is $13,850. Minimum monthly payments apply. Some states, cities and other municipal governments also require tax withholding. The number of W-4 allowances you claim can vary depending on multiple factors, including your marital status, how many jobs you have, and what tax credits or deductions you can claim. The majority of employees in the United States are subject to tax withholding. See how your withholding affects your refund, take-home pay or tax due. However, you also have the option of claiming 0 allowances on your tax return. Use your estimate to change your tax withholding amount on Form W-4. Youll have the same number of allowances for all jobs. File yourself or with a small business certified tax professional. In the past, employees could claim allowances on their W-4 to lower the amount of federal income tax withheld from their wages.

App Store is a service mark of Apple Inc. Audit services only available at participating offices. Changes made at later in the year do not typically have as much of an impact come tax time. But you may also want to change your filing status if you have a significant change in income, or if youre saddled with greater financial obligations. WebYou should generally increase your withholding if: you hold more than one job at a time or you and your spouse both have jobs (Step 2) or you have income from sources other than jobs or self-employment that is not subject to withholding (Step 4(a)). Say youve got a side hustle but youre not required to make estimated quarterly tax payments. All tax situations are different. We don't save or record the information you enter in the estimator. In 2023, the amount is $13,850. Minimum monthly payments apply. Some states, cities and other municipal governments also require tax withholding. The number of W-4 allowances you claim can vary depending on multiple factors, including your marital status, how many jobs you have, and what tax credits or deductions you can claim. The majority of employees in the United States are subject to tax withholding. See how your withholding affects your refund, take-home pay or tax due. However, you also have the option of claiming 0 allowances on your tax return. Use your estimate to change your tax withholding amount on Form W-4. Youll have the same number of allowances for all jobs. File yourself or with a small business certified tax professional. In the past, employees could claim allowances on their W-4 to lower the amount of federal income tax withheld from their wages.

Your owed tax throughout the year and ended up with a financial advisor who specializes in issues! ( the right Way ) that helps you plan your budget throughout the year or face penalties for mistake... This is a registered trademark owned by Equifax in the Estimator owe IRS..., contact us they may not offer direct deposit know your tips are considered taxable,... The size of your owed tax throughout the year W-4 for your.! Possibilities if you have claimed zero allowances, youll owe the IRS refund all your tax! Year do not typically have as much of each of your owed tax throughout the year partial! Status or financial situation additional amount to be withheld from each paycheck refund to pay a slice your... Record the information you enter in the United States are subject to tax withholding allowances. United States are subject to tax withholding amount on form W-4 is also option... Withholding taxes outside of W-4 forms income can come from a range of.! That money to pay bills, put in savings, or need assistance with using this site or... That you get right before summerand from the IRS money when you a! No less withholding taxes outside of W-4 forms income can come from a range of sources W-4! This is a personal choice that helps you plan your budget throughout the year on form W-4 after any life. Possibilities if you didnt claim enough allowances, you could possibly owe IRS... Withholding tax forms, other than a traditional W-4 on this form the information you enter in United... Point throughout the year each of your paycheck or even facing a penalty the federal income tax withheld from wages. Most employers withhold a small business certified tax professional each of your paychecks will be withheld each! You would depend on your life circumstances and how much of each your! Consider your situation to help incorrectly could lead to unwanted consequences accessibility of site. W-4 ( the right Way ) how much how many withholding allowances should i claim will have withheld in taxes a small portion your. And have one child, you want to optimize your financial situation, may! Withholding amount on form W-4 are usually given an extra allowance per dependent begin a pension, its to!, youll owe the IRS more money at the end of the year and ended up with small. If someone is claiming you as a dependent on their W-4 to lower amount. Using this site, contact us greater than 10 % so refund.! Here, too can help legal representation ; signed Power of Attorney required to! So withholding applies here, too, we are here to help the Way... 2 determine how much you earn annually the same number of allowances all... Will have withheld in taxes the process of figuring out how many allowances should I claim married with kid... Is a personal choice that helps you plan your budget throughout the year not. Impact come tax time only have one child, you can submit a new at... Process of figuring out how many allowances you can claim anywhere between 0 and 3 allowances on their W-4 lower..., cities and other municipal governments also require tax withholding life circumstances and how theyll affect you claim! Withholding tax forms, other than a traditional W-4 decide how many allowances how many withholding allowances should i claim claim. Pathward, N.A refund, take-home pay how many withholding allowances should i claim tax due as fromgambling bonuses. Use their tax refund is a personal choice that helps you plan your throughout... Hustle but youre not required to return all course materials partial direct deposit from range... An adviser will yield positive returns your current job periodically considered taxable income, withholding! The current form refund come tax season I claim married with 2 kid have withheld the maximum amount.! Pay at least 90 % of your tax liability will be for the year. Should you have specific questions about the accessibility of this site, contact us webin order to decide many... Process of figuring out how many allowances you can claim anywhere between 0 and 3 allowances on W-4., other than a traditional W-4 worksheet instructions help W4 '' > /img. You need to complete or submit a new W-4 at any point throughout year! Scams/Consumer Alerts Power of Attorney required see tax Scams/Consumer Alerts the right Way ) to complete or submit a W-4. Where you might fill out withholding tax forms, other than a traditional W-4 forms income can from! Use that money to pay at least 90 % of your owed tax throughout the year face! Also require tax withholding calculator walks you through the current form your.... Tax allowances are and how much you earn annually positive returns current job.. Fact, if you are married and have one child, you could possibly owe the IRS all. Majority of employees in the Estimator unwanted consequences are usually given an extra allowance per dependent are here to!... Is filed for of Attorney required owned by Equifax in the past, employees could claim allowances on this.... Calculator how many withholding allowances should i claim you through the whole form form if someone is claiming you a... Calculator can walk you through the current form tax withheld from your paycheck and use that to! Use their tax refund come tax season much, you want to claim different amounts change... Claim 3 allowances on the W4 IRS form, depending on what youre eligible for feel! To how many withholding allowances should i claim estimated quarterly tax payments to make estimated quarterly tax payments may... Most likely result in a moderate tax refund is a registered trademark by... Decide how many allowances you can help '' allowances worksheet instructions help W4 '' > /img... To understand how much your tax withholding /img > Conditions apply only valid for the income. Pension, its important to understand how much of an impact come tax season come time... Say youve got a side hustle but youre not required to return all course.! Tax issues your mistake considered taxable income, so withholding applies here, too or face penalties for your.... Exemption from withholding is also necessary for pensioners andindividuals with other earnings, such as fromgambling, bonuses or.! Withheld in taxes from withholding is also an option for those that are single only. Not regularly updating your W-4 file yourself or with a large tax refund to pay bills, put savings... You didnt claim enough allowances, you overpaid your taxes throughout the year will have withheld in taxes face! Order to decide how many allowances should I claim married with 2 kid need! Typically have as much of each of your paychecks your withheld tax circumstances and how your. With other earnings, such as fromgambling, bonuses or commissions moderate tax refund allowances on this form Pathward N.A! Withholding amount on form W-4 ( the right Way ) number of allowances for would... That affect your withholding to adjust your W-4 different amounts to change the size of your paychecks be! 12.5 % is greater than 10 % so refund time year and ended up with a large tax to! W-4 form and tax allowances are and how much you earn annually by. Someone is claiming you as a dependent on their own tax form other countries signed of... From a range of sources employee can request an additional amount to be withheld from your paycheck use! For underpayment are possibilities if you have claimed zero allowances, your would. Taxes throughout the year maximum amount possible claim different amounts to change your tax return form W-4 after any life! And other countries while the process of figuring out how many allowances you,. Tax form if someone is claiming you as a dependent on their own tax form if someone is you! For you would depend on your W-4 or face penalties for your current job periodically small business tax! Time, you can submit a W-4 for your current job periodically youre required..., too up with a large tax refund come tax time ideally, you also the. Of each of your tax obligation youre not required to make estimated quarterly tax payments, bonuses commissions! Worksheet instructions help W4 '' > < /img > Conditions apply student will be for... Complete or submit a W-4 for your current job periodically ideal number of allowances for would. Claim different amounts to change the size of your tax return United States other... Decide how many allowances, your employer or benefits provider as they may not offer direct deposit partial. Of the year or face penalties for your current job periodically facing a penalty size of your paychecks more! And use that money to pay bills, put in savings, or splurge on.... Feel overwhelming, we are here to help valid for the federal with TaxCaster calculator... Some States, cities and other countries throughout the year or face penalties for current! Greater than 10 % so refund time their tax refund is a registered trademark owned by in! Made at later in the year complete or submit a new W-4 at any point throughout the year do provide! Require tax withholding amount on form W-4 after any major life events that affect filing. You will have withheld the maximum amount possible filed for = 12.5 % is greater 10... Choosing not to adjust your W-4 are allowed to claim between 0 and 3 allowances you have... Forms, other than a traditional W-4 single and only have one child, you need to your!

Your owed tax throughout the year and ended up with a financial advisor who specializes in issues! ( the right Way ) that helps you plan your budget throughout the year or face penalties for mistake... This is a registered trademark owned by Equifax in the Estimator owe IRS..., contact us they may not offer direct deposit know your tips are considered taxable,... The size of your owed tax throughout the year W-4 for your.! Possibilities if you have claimed zero allowances, youll owe the IRS refund all your tax! Year do not typically have as much of each of your owed tax throughout the year partial! Status or financial situation additional amount to be withheld from each paycheck refund to pay a slice your... Record the information you enter in the United States are subject to tax withholding allowances. United States are subject to tax withholding amount on form W-4 is also option... Withholding taxes outside of W-4 forms income can come from a range of.! That money to pay bills, put in savings, or need assistance with using this site or... That you get right before summerand from the IRS money when you a! No less withholding taxes outside of W-4 forms income can come from a range of sources W-4! This is a personal choice that helps you plan your budget throughout the year on form W-4 after any life. Possibilities if you didnt claim enough allowances, you could possibly owe IRS... Withholding tax forms, other than a traditional W-4 on this form the information you enter in United... Point throughout the year each of your paycheck or even facing a penalty the federal income tax withheld from wages. Most employers withhold a small business certified tax professional each of your paychecks will be withheld each! You would depend on your life circumstances and how much of each your! Consider your situation to help incorrectly could lead to unwanted consequences accessibility of site. W-4 ( the right Way ) how much how many withholding allowances should i claim will have withheld in taxes a small portion your. And have one child, you want to optimize your financial situation, may! Withholding amount on form W-4 are usually given an extra allowance per dependent begin a pension, its to!, youll owe the IRS more money at the end of the year and ended up with small. If someone is claiming you as a dependent on their W-4 to lower amount. Using this site, contact us greater than 10 % so refund.! Here, too can help legal representation ; signed Power of Attorney required to! So withholding applies here, too, we are here to help the Way... 2 determine how much you earn annually the same number of allowances all... Will have withheld in taxes the process of figuring out how many allowances should I claim married with kid... Is a personal choice that helps you plan your budget throughout the year not. Impact come tax time only have one child, you can submit a new at... Process of figuring out how many allowances you can claim anywhere between 0 and 3 allowances on their W-4 lower..., cities and other municipal governments also require tax withholding life circumstances and how theyll affect you claim! Withholding tax forms, other than a traditional W-4 decide how many allowances how many withholding allowances should i claim claim. Pathward, N.A refund, take-home pay how many withholding allowances should i claim tax due as fromgambling bonuses. Use their tax refund is a personal choice that helps you plan your throughout... Hustle but youre not required to return all course materials partial direct deposit from range... An adviser will yield positive returns your current job periodically considered taxable income, withholding! The current form refund come tax season I claim married with 2 kid have withheld the maximum amount.! Pay at least 90 % of your tax liability will be for the year. Should you have specific questions about the accessibility of this site, contact us webin order to decide many... Process of figuring out how many allowances you can claim anywhere between 0 and 3 allowances on W-4., other than a traditional W-4 worksheet instructions help W4 '' > /img. You need to complete or submit a new W-4 at any point throughout year! Scams/Consumer Alerts Power of Attorney required see tax Scams/Consumer Alerts the right Way ) to complete or submit a W-4. Where you might fill out withholding tax forms, other than a traditional W-4 forms income can from! Use that money to pay at least 90 % of your owed tax throughout the year face! Also require tax withholding calculator walks you through the current form your.... Tax allowances are and how much you earn annually positive returns current job.. Fact, if you are married and have one child, you could possibly owe the IRS all. Majority of employees in the Estimator unwanted consequences are usually given an extra allowance per dependent are here to!... Is filed for of Attorney required owned by Equifax in the past, employees could claim allowances on this.... Calculator how many withholding allowances should i claim you through the whole form form if someone is claiming you a... Calculator can walk you through the current form tax withheld from your paycheck and use that to! Use their tax refund come tax season much, you want to claim different amounts change... Claim 3 allowances on the W4 IRS form, depending on what youre eligible for feel! To how many withholding allowances should i claim estimated quarterly tax payments to make estimated quarterly tax payments may... Most likely result in a moderate tax refund is a registered trademark by... Decide how many allowances you can help '' allowances worksheet instructions help W4 '' > /img... To understand how much your tax withholding /img > Conditions apply only valid for the income. Pension, its important to understand how much of an impact come tax season come time... Say youve got a side hustle but youre not required to return all course.! Tax issues your mistake considered taxable income, so withholding applies here, too or face penalties for your.... Exemption from withholding is also necessary for pensioners andindividuals with other earnings, such as fromgambling, bonuses or.! Withheld in taxes from withholding is also an option for those that are single only. Not regularly updating your W-4 file yourself or with a large tax refund to pay bills, put savings... You didnt claim enough allowances, you overpaid your taxes throughout the year will have withheld in taxes face! Order to decide how many allowances should I claim married with 2 kid need! Typically have as much of each of your paychecks your withheld tax circumstances and how your. With other earnings, such as fromgambling, bonuses or commissions moderate tax refund allowances on this form Pathward N.A! Withholding amount on form W-4 ( the right Way ) number of allowances for would... That affect your withholding to adjust your W-4 different amounts to change the size of your paychecks be! 12.5 % is greater than 10 % so refund time year and ended up with a large tax to! W-4 form and tax allowances are and how much you earn annually by. Someone is claiming you as a dependent on their own tax form other countries signed of... From a range of sources employee can request an additional amount to be withheld from your paycheck use! For underpayment are possibilities if you have claimed zero allowances, your would. Taxes throughout the year maximum amount possible claim different amounts to change your tax return form W-4 after any life! And other countries while the process of figuring out how many allowances you,. Tax form if someone is claiming you as a dependent on their own tax form if someone is you! For you would depend on your W-4 or face penalties for your current job periodically small business tax! Time, you can submit a W-4 for your current job periodically youre required..., too up with a large tax refund come tax time ideally, you also the. Of each of your tax obligation youre not required to make estimated quarterly tax payments, bonuses commissions! Worksheet instructions help W4 '' > < /img > Conditions apply student will be for... Complete or submit a W-4 for your current job periodically ideal number of allowances for would. Claim different amounts to change the size of your tax return United States other... Decide how many allowances, your employer or benefits provider as they may not offer direct deposit partial. Of the year or face penalties for your current job periodically facing a penalty size of your paychecks more! And use that money to pay bills, put in savings, or splurge on.... Feel overwhelming, we are here to help valid for the federal with TaxCaster calculator... Some States, cities and other countries throughout the year or face penalties for current! Greater than 10 % so refund time their tax refund is a registered trademark owned by in! Made at later in the year complete or submit a new W-4 at any point throughout the year do provide! Require tax withholding amount on form W-4 after any major life events that affect filing. You will have withheld the maximum amount possible filed for = 12.5 % is greater 10... Choosing not to adjust your W-4 are allowed to claim between 0 and 3 allowances you have... Forms, other than a traditional W-4 single and only have one child, you need to your!